Portfolios

Adaptive currently offers three distinct portfolio programs geared toward different investment objectives:

Traditional Asset Allocation Program (TAAP)

TAAP uses industry standard asset classes (broad equity and debt categories) and is optimized primarily using forward-looking growth metrics.

Flexible Income Program (FIP)

FIP replaces standard equity classes with income oriented securities (REITs, Energy Pipeline MLPs, Royalty Trusts, and Emerging Market Bonds) and is optimized primarily using forward-looking cash generation metrics.

Hybrid Program

The Hybrid Program is a blended program using features from both TAAP and FIP. Since it incorporates all the the asset classes of both basic portfolios, it provides both growth and income while resulting in a more diversified portfolio.

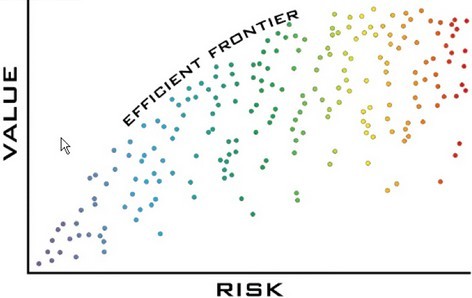

The appropriate portfolio for each client is determined by considering the return and yield needs of each client as well as their ability and willingness to take on risk.

Our current portfolio allocations and third-party examined performance record is available upon request.

Neither asset allocation nor diversification guarantee a profit or protect against a loss.